92%

Of Startups Fail - the right insight changes the odds

10,000+

Our platform continuously ingests thousands of global economic indicators every week

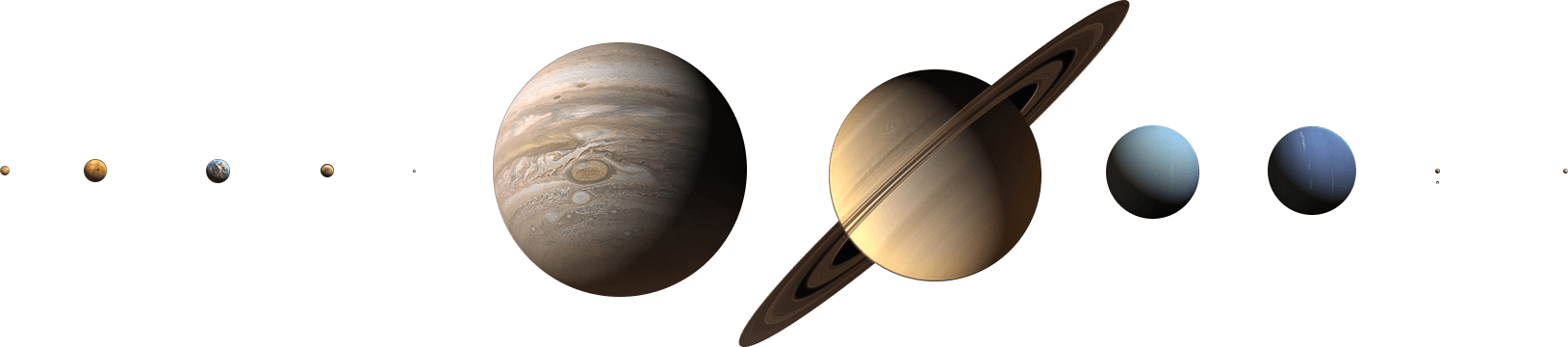

THE INVESTMENT ECOSYSTEM

Markets behave like systems—complex, interconnected, and constantly evolving. Understanding each macroeconomic element is key to making resilient investment decisions.

At Sky Invest, we analyze the forces of inflation, rates, liquidity, and innovation—each orbiting within the broader economy and shaping startup trajectories.

Just as planets rely on gravity, we rely on macro signals to map risk, time entry points, and uncover transformative investment opportunities.

Investment ecosystems are driven by macro forces.

At Sky Invest, we translate global complexity into strategic clarity—connecting macroeconomic trends with startup-specific insights through an ecosystem-based approach.

That empowers investors to forecast more accurately, invest more wisely, and align their vision with the real-world momentum driving the future of innovation.

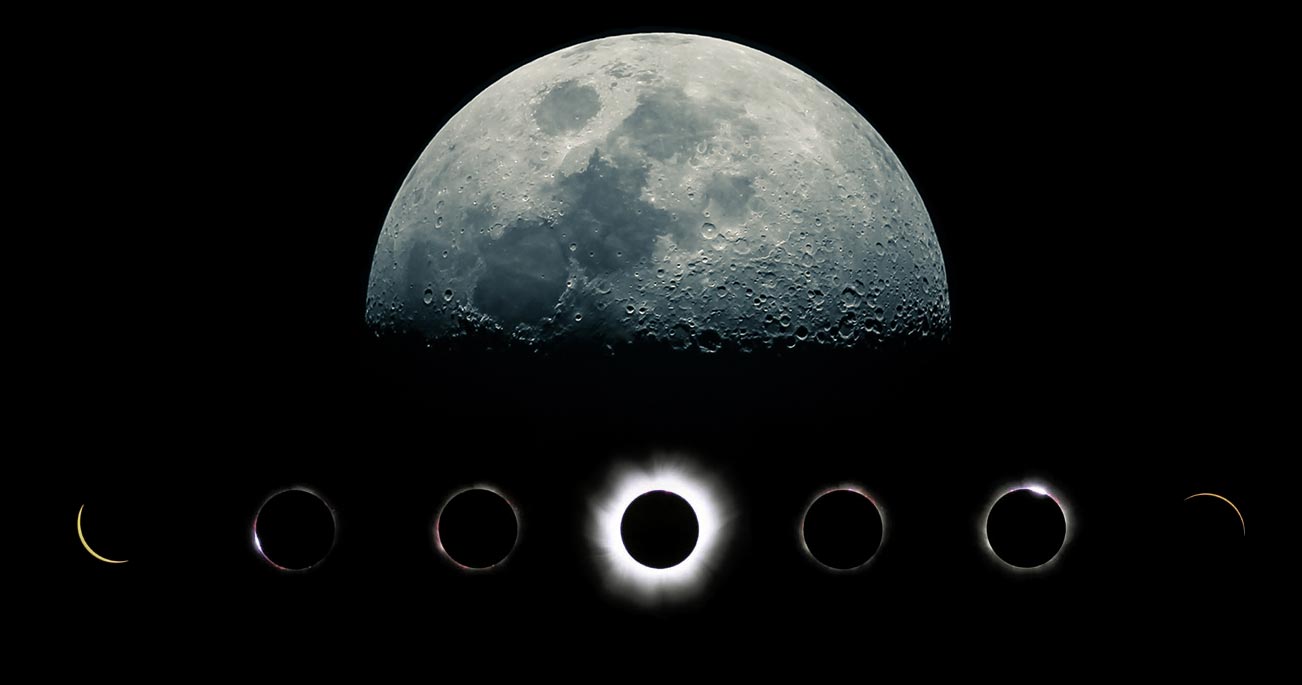

CYCLES DEFINE OPPORTUNITY

Just like the moon, markets move in cycles. At Sky Invest, we identify where we are in the macroeconomic and startup lifecycle—ensuring our capital and strategy align with momentum, not resistance.

From early-stage investments to portfolio exits, timing isn’t luck—it’s pattern recognition.

The Twin Threats

Startups and markets face two constant challenges: timing and capital. One can accelerate growth, the other can destroy it.

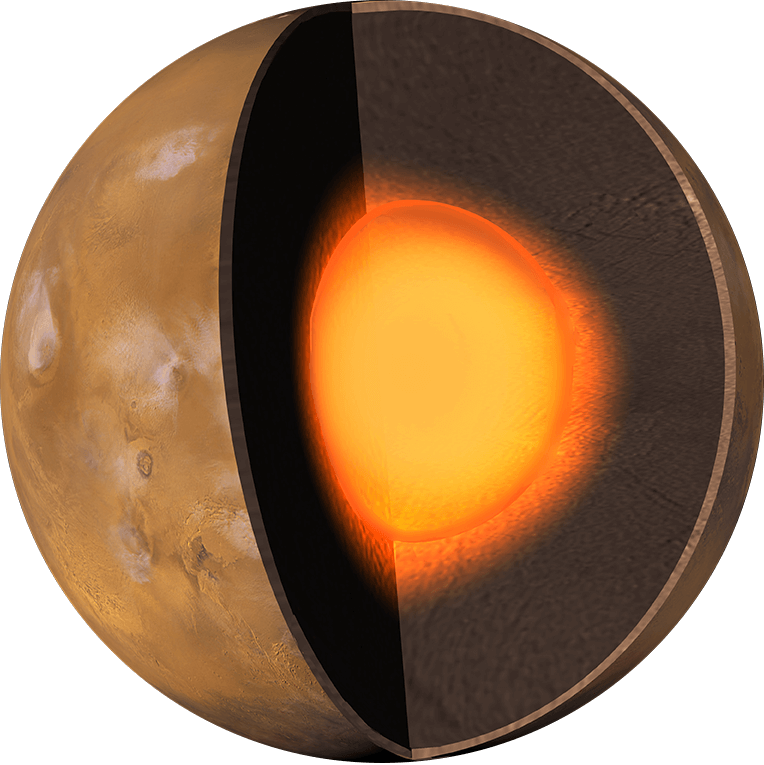

Readiness

Just like Mars needs an atmosphere to support life, startups need strategic structure to attract capital. We work with teams to shape clarity, governance, and timing—so they’re ready when opportunity aligns.

Our mission is simple:

Connect capital with conviction.

Decode cycles.

Back visionaries.

Because real innovation doesn’t just survive disruption—

it drives it.

THE EARTH

At Sky Invest, we stay grounded in reality—even when our ambitions reach beyond it. Our analysis starts with data from the real world: economic indicators, policy shifts, human behavior, and capital flows.

We believe that understanding what’s happening here on Earth—across governments, markets, and technologies—is the foundation of forecasting what comes next.